montana sales tax rate 2019

Montana Department of Revenue. The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages.

Montana limits the amount of Federal taxes which can be deducted to 10000 for a mar- ried couple filingjointly.

. The state sales tax rate in Montana is 0000. Your free and reliable 2019 Montana payroll and historical tax resource. Montana MT Sales Tax Rates by City.

There are a total of 68 local tax jurisdictions across the. Montana charges no sales tax on purchases made in the state. Montana Constitution as amended in 1972 provides for up to a 4 sales tax.

The revised tax year 2019 taxable percentage rate for class 12 property is estimated to be 320. 25000 x 69 0069 1725. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg.

There is no state sales tax in Montana. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA. Per 15-6-145 MCA the Department of Revenue shall calculate the taxable percentage rate for.

Tax Foundation Facts and Figures 2019 - Table 12 for 2019 2. Montana is one of only five states without a general sales tax. The Montana MT state sales tax rate is currently 0.

Imposition and rate of sales tax and use tax -- exceptions. There are no local taxes beyond the state rate. Tax rate of 4 on taxable income between 8901 and 12000.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate Alabama 400 40 514 914 5. Goods and services can be.

In 2020 Montana ranked 26th in 2019. The five states with the highest average combined state and local sales tax rates are Tennessee and Arkansas 947 percent Louisiana 945 percent Washington 921. You can learn more about licensing and distribution from the Alcoholic.

1725 - 587 1138 tax. In effect that lowers the top capital gains tax rate in Montana from 69 to 49. Tax rate of 6 on taxable income between.

Your free and reliable 2019 Montana payroll and historical tax resource. Tax rate of 5 on taxable income between 12001 and 15400. The state sales tax rate in Montana is 0000.

Skip to main content. By Justin Fontaine July 26 2019. Your taxable income is 25000.

The bill opens the door with a 25 tax that will go into effect on January 1 2020. Montana tax rate is unchanged from.

States Without Sales Tax Article

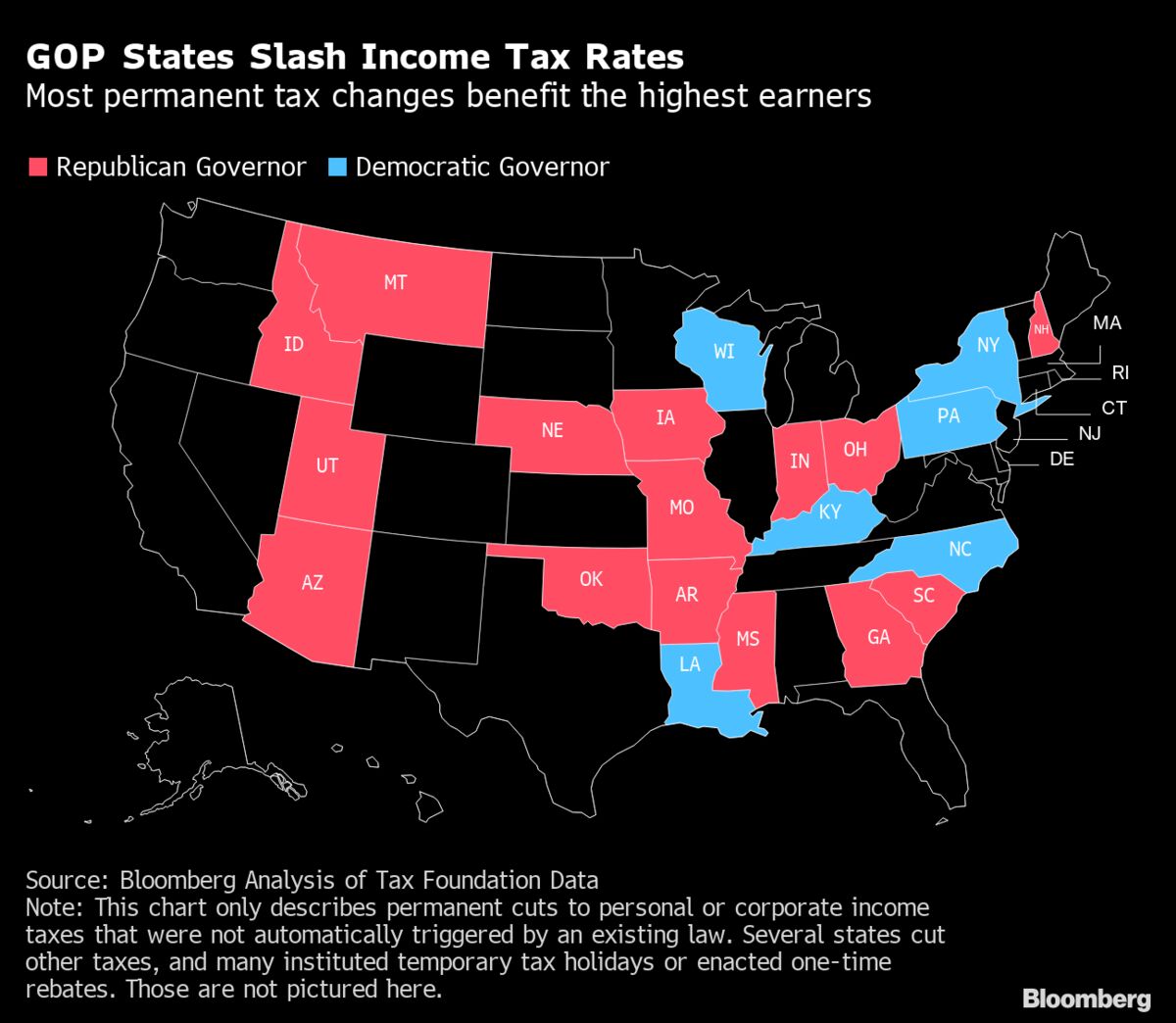

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Without Sales Tax Article

State Taxes On Capital Gains Center On Budget And Policy Priorities

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

Amazon Tax Guide For Canadian Sellers In The United States Canada Baranov Cpa

U S Sales Taxes By State 2020 U S Tax Vatglobal

How Do State And Local Sales Taxes Work Tax Policy Center

Montana State Taxes Tax Types In Montana Income Property Corporate

Taxes Fees Montana Department Of Revenue

State And Local Tax Collections State And Local Tax Revenue By State

Montana State Taxes Tax Types In Montana Income Property Corporate

State Corporate Income Tax Rates And Brackets Tax Foundation